How to Elevate User Research Impact on Both Levels: Tactical and Strategic

We often hear from user researchers getting requests from a product manager who has already decided what features need to go to the backlog and in what priority. The product team calls a researcher to learn the best way to build a specific feature or to test that they have created something right. As a result, researchers are left with evaluative work and remain uninvolved in building that backlog. For a company, this might lead to missing opportunities or wasted resources. How can a user researcher change that unproductive working behavior and drive business impact?

Dr. Natalia Korchagina, Ex. Head of Product and Market Research at Tiger.Trade and Lead User Researcher at Bitvavo, discussed this question in one of our recent UX Research Munich Community talks. She shared her experience of elevating the impact of user research at different levels: from tactical to strategic. Inspired by Natalia’s talk, this article reflects on the concept of strategic research. It also provides several strategies for user researchers to help their stakeholders explore and evaluate assumptions behind why a specific feature should be prioritized and how it will impact reaching the business goals.

- Why strategy is different from tactics

- The importance of strategic user research

- Finding strategical opportunities

- Performing strategic research

- 5 stages of a strategy-driven research process

- Identifying the right time for strategic research

- How to convey the need for strategic research

- 1st way: Use tactical work to provoke strategic questions

- 2nd way: Mind how to take on a new research request

- Case study: Learnings from Natalia’s experience

- Wrap-up

- Watch recording 🎥

Why strategy is different from tactics

First, let’s make a short management recoup and clarify the difference between strategy and tactics. Simply put, strategy is about where and why you want to go. The tactic is about how to get there if we break it down.

Business strategy development usually involves answering questions about whether to go to the chosen markets and market segments. Some typical questions to ask:

Who do your company and product exist for?

Who is your core client?

Who is your aspirational client?

What value do your company and product create for them?

When the desired markets and segments are defined, it’s time to consider how to win them. Identifying two things can help: strategic opportunities to focus on and initiatives to implement to realize these opportunities.

Only then tactical planning comes into play to unpack what needs to happen within each strategic initiative. Some questions to facilitate that process:

What exactly is needed to be done?

What resources are needed?

What timelines are realistic?

What is the right way to measure success?

Is there anything needed to be improved or pivoted?

In short, what differentiates strategy from tactics is being intentional in making choices and equally prioritizing the way to invest efforts or not. That distinction is also relevant in the context of user research. Aiming at elevating the impact of research, pay attention to its strategic level.

The importance of strategic user research

Imagine you asked your stakeholders from different teams what defines their strategy. There is a high chance that many of them would state their strategy is driven by business impact. But that’s not necessarily the case with people making product decisions.

Some product teams operate according to the logic of project teams. They might define impact in terms of productivity rather than of business impact by looking at indicators like:

Number of released features

Duration of those releases

Number of milestones achieved in a time

In the bigger picture, productivity does not equal bringing more business impact. As a user researcher, taking time and observing how product decisions are actually made in your organization is helpful. For example, suppose that the statements about strategy do not align with the processes. In that case, you can initiate a strategic mindset shift by identifying areas where your stakeholders can increase their impact on users and their business. In other words, try employing a strategic user research approach.

Finding strategical opportunities

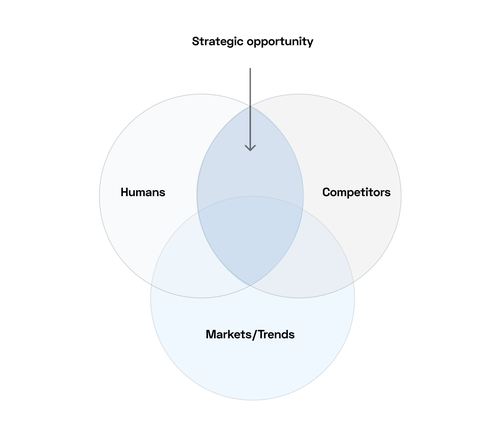

Strategic research, in Natalia’s perspective, includes user research, competitive intelligence, and market and trend analysis:

Knowledge about humans: people you want to serve with your service or product. Aka, User Research. It can give you valuable insights into what will impact those people the most.

Knowledge about competitors: it can help you make better product decisions about what might drive more business impact as you learn from others.

Knowledge about markets and trends: it helps to see the complete picture as well as market dynamics. You may spot a fast-growing market segment where you could expand.

If you want, it’s the process of zooming in and out: zoom in to the micro level of humans or competitors and zoom out to a more macro level of markets. The most promising strategic opportunities are often derived from the intersection of these three insight areas. Therefore, working on strategic research will help you boost the impact of research in your organization.

Performing strategic research

You learned about the value of strategic research and may think about how to implement it. Whether you’re eager to become the center of expertise in all three areas or you’d better keep focusing on what you do best - user research, both could work.

Typically, companies store the knowledge from these areas with different teams, combining puzzle pieces. For example, you share user research insights, the marketing team might perform competitor analysis, and product managers collect corporate development information. Oftentimes there is nobody to synthesize all these different pieces of insight, which is essential to inform strategic decisions.

/f/99166/3802x1836/9496e05787/nalatia)

When aiming to drive the strategic approach, it’s your time to try taking the role of that facilitator who brings the stakeholders together to combine the knowledge about these areas. Having the complete picture, the goal is to find new strategic capacities for your product. Once you have a range of strategic opportunities, start thinking about JTBD (jobs to be done) to realize them. Next, you can prioritize core strategic initiatives and, finally, plan your tactics.

Sounds like a lot of work? Don't DO this all alone. Instead, initiate collaboratively going through the process: set up a strategic brainstorming session with your stakeholders. Encourage them to collaborate and organize some room for it. For example, conduct explorative sessions together on a digital whiteboard. You can simultaneously cluster research data or create user journey maps, zooming in or out to the right level of detail. The impact of your research may reach a new organizational level if you invest time and effort into this collaboration.

To stay focused and productive during your brainstorming session, follow a framework for employing strategic research like the one below.

5 stages of a strategy-driven research process

If you include strategic research into the UX research process, it is a five-stage process:

Discovery stage: to explore the three areas (users, competitors, markets/trends) and identify strategic opportunities.

Prioritization stage: to prioritize between these opportunities based on their contribution to the key business metrics.

Definition stage: to identify strategic initiatives or programs of action on a high level.

Development stage: to establish a development plan for these initiatives and determine which approach best solves the problem.

Delivery stage: to iterate and evaluate the outcomes or do evaluative research. Based on the metrics, decide if there is a need to improve or pivot.

„What makes research 'strategic' is being relevant to the stage of the product and business.“

Identifying the right time for strategic research

Meeting the company and its product where they are might be challenging, especially if you joined a company recently. You’re neither very familiar with the business nor the product. Sometimes a company had no research function before you joined. Sometimes it has, but you don’t yet know about its quality. Jumping straight into the extensive fundamental work of strategic research can be risky. What if your research outcomes have little relevance because there’s no time for your team to act upon them?

Before committing to strategic research, it’s essential to diagnose where the business and product are right now. Only then you might provide relevant recommendations.

There is a short checklist to help you explore assumptions together with your stakeholders. Get in touch and try to learn about:

- Who are their customers?

- What are the problems the company is solving for these customers?

- Has the company reached product market fit?

- Does the company product meet users’ needs?

- Are users willing to pay for the product?

- What does the current user experience look like?

- Are there problems with the current user experience?

- Are users happy with the product?

When you collect those assumptions, remember to validate them first. If they turn out wrong, you might deliver an irrelevant strategy, wasting time and resources.

Your stakeholders might tell you they want to expand their product to new customer segments or markets. Yet you observed that the current user experience is not satisfying, as many users complain about it. In that case, your stakeholders might need to postpone thinking about scaling to a later stage. Your job is to address the most urgent issues and focus the efforts accordingly.

However, sometimes your team needs to be more convinced of the need for strategic research. But, then, it’s not easy to convince the team to devote time to it and raise strategic questions. Is there anything you can do about this?

How to convey the need for strategic research

There are different ways to encourage the team to move from tactical research requests to more strategic ones.

1st way: Use tactical work to provoke strategic questions

Start with analyzing your tactical work and operational tasks. Then, doing that, aim at framing your user study to see whether you can expand it: is there a bigger business question behind this part of the user experience you are testing? Following this approach, you’re conducting a study about usability and identifying urgent strategic questions, which are then addressed on a team level. You’ll find an example in the case study below.

The extensive exploration process is then mostly on your shoulders. Meanwhile, you can still engage your stakeholders early in the research process.

2nd way: Mind how to take on a new research request

Imagine your team comes with a new project request. In the project briefing session, the surface team’s assumptions on how they can reach their business goals. You can achieve that by asking them about the business goals and product metrics they want to impact.

Then, you can turn the assumptions of your stakeholders into research questions. As a result, you will reframe the research value from helping the team implement the feature they have already decided to implement to learning about the current user needs and challenges and finding essential opportunities.

The ultimate role of research is not only to perform research requests from the team but to operate strategically and drive impact on the strategic level.

Here is a short story of how Natalia’s team used both ways to convey their organization's need for strategic research.

Case study: Learnings from Natalia’s experience

Natalia works at a company that builds software solutions for trading. She shared how the product team requested a customer onboarding process usability study.

To tackle that project, Natalia’s research team identified the parts of user experience before onboarding. Going back to the first step in a customer journey, the research team focused on how the product and the company were perceived based on the website communication: users need to install the application they find on the company website.

One of the app mockups on the website contained a particular type of stock chart, perceived as too sophisticated for many users. Although the product targeted people with different experience levels, some professional traders found it tricky to read or use the chart in their analysis.

As a result, the website communicated that the product was more professional than its potential users. In other words, Natalia’s team found that the company’s core clients didn’t identify themselves with the product. As a result, the bottleneck appeared to potential customers before they entered the onboarding process. So, the usability study request dropped because the user research team first learned about the customer's struggles by asking fundamental questions.

Let’s reflect on Natalia’s story. Product teams might be very much committed to their current solutions because of the switching costs. Meanwhile, these solutions might contain significant pain points for the current product users. User research might be helpful to account for that by taking a step back and exploring:

What are the switching costs?

Is any critical customer journey part missed?

Are there any prominent switching barriers?

Is it possible to reduce those switching barriers?

That essential UX research work, on both tactical and strategic levels, might help attract new users to the product or retain more current customers just as it happened in Natalia’s case.

Long story short, she illustrated how to use tactical work to provoke strategic questions and why it's helpful to move from "Are we building the thing right?" to "Are we working on the right problem?" when taking on a new research request.

Wrap-up

Sometimes, when making decisions, product stakeholders focus on business goals so much that they don’t have enough time to explore how to get there. That's where user research can become a strategic partner and help evaluate assumptions behind why a specific feature is the current best option for driving business impact.

As a strategic researcher, remember the following:

Strategy is about making choices based on what will drive the most business impact while focusing on the user's needs.

What makes research strategic is addressing strategy-level questions and developing a program that is very relevant to your company's stage and its product.

Trust your stakeholders to do their job. Still, treating their input as a hypothesis that needs to be validated to spot strategic opportunities can be useful. Be critical when determining strategic opportunities in your organization before you commit to developing a strategic research program.

If you're not given time and space to perform strategic work, use tactical work to provoke strategic questions and reframe the value of research as helping test assumptions.

Watch recording 🎥

This article is inspired by Dr. Natalia Korchagina’s talk at UX Research Munich Meetup in December 2022. You can watch the full talk here:

/f/99166/3792x1890/96c89dd516/natalia)